Welcome

Mutual Fund Observer's premium site provides fund screening tools, analytics, and ratings, plus additional

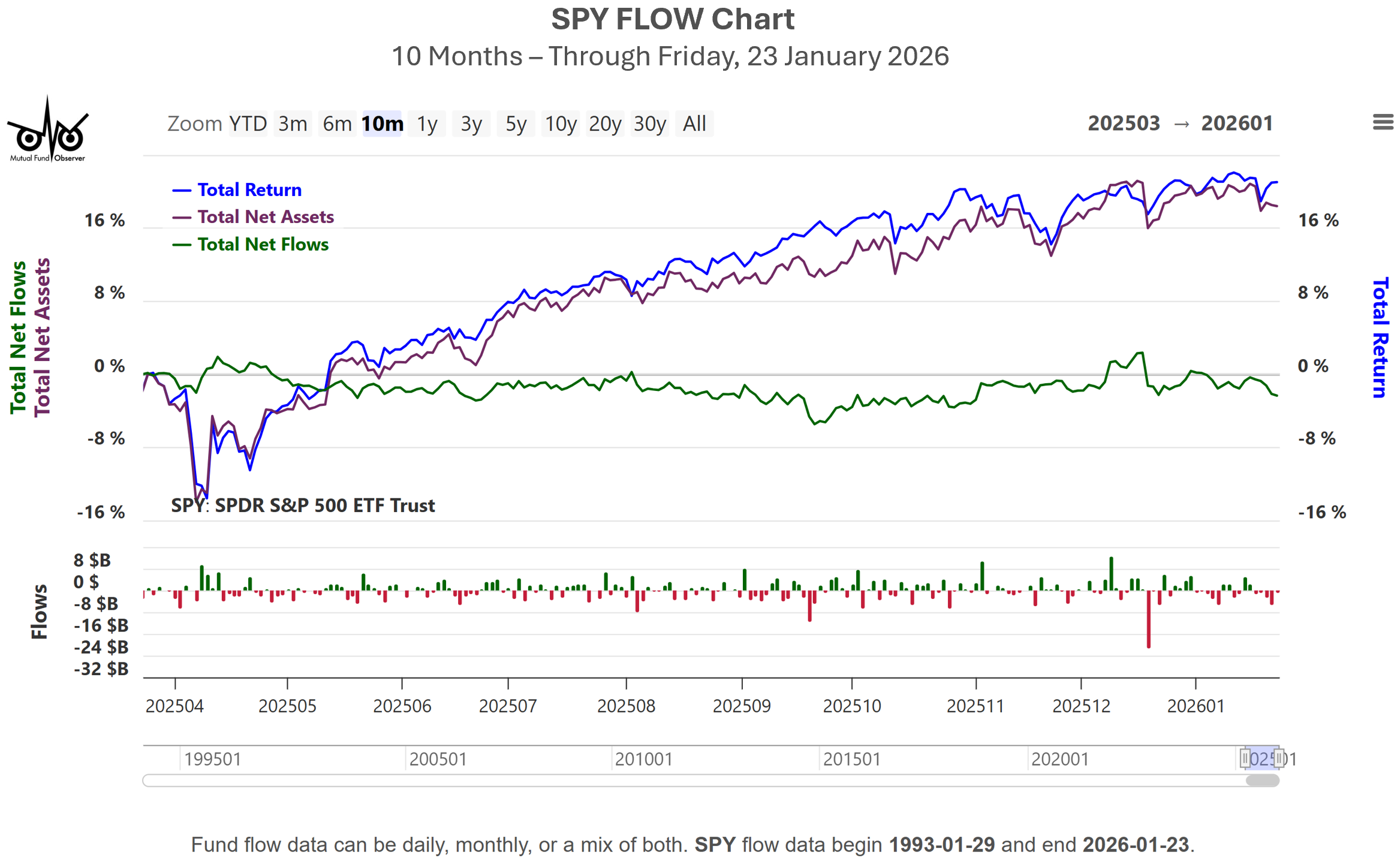

commentary to complement our main site. Our ratings update monthly and our FLOW tool, which combines fund flow, assets, and return, updates daily.

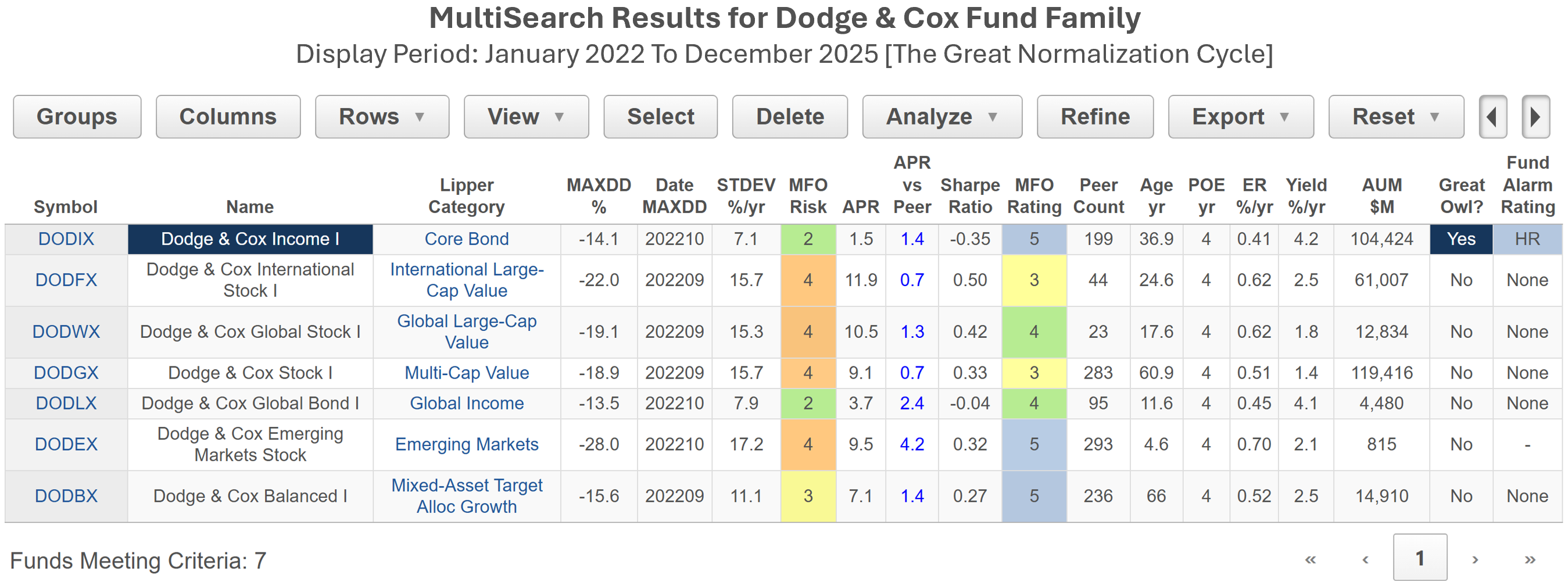

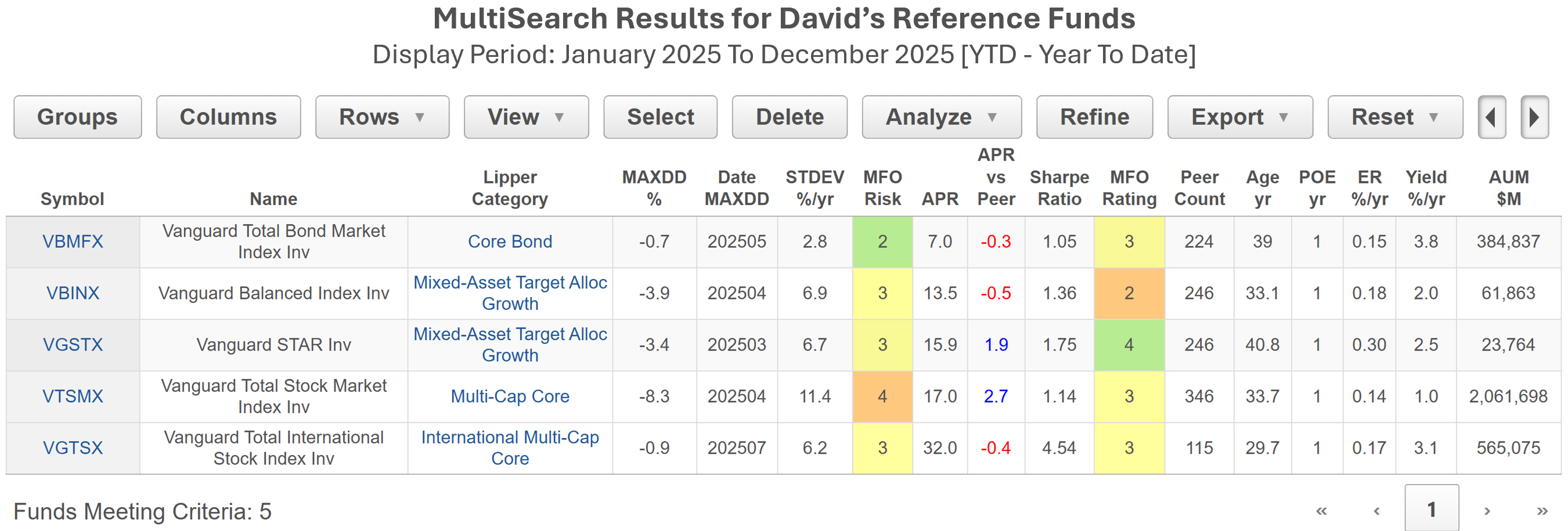

MultiSearch, our main search tool, will sort through thousands of funds based on up to 300 screening criteria. Its Pre-Set Screens provide an easy way to get a quick overview on markets and notable funds. The example below depicts risk and return metrics for the Dodge & Cox fund family during the current market cycle, coined "The Great Normalization." Only a few of the more than 1000 metrics available in the table are illustrated.

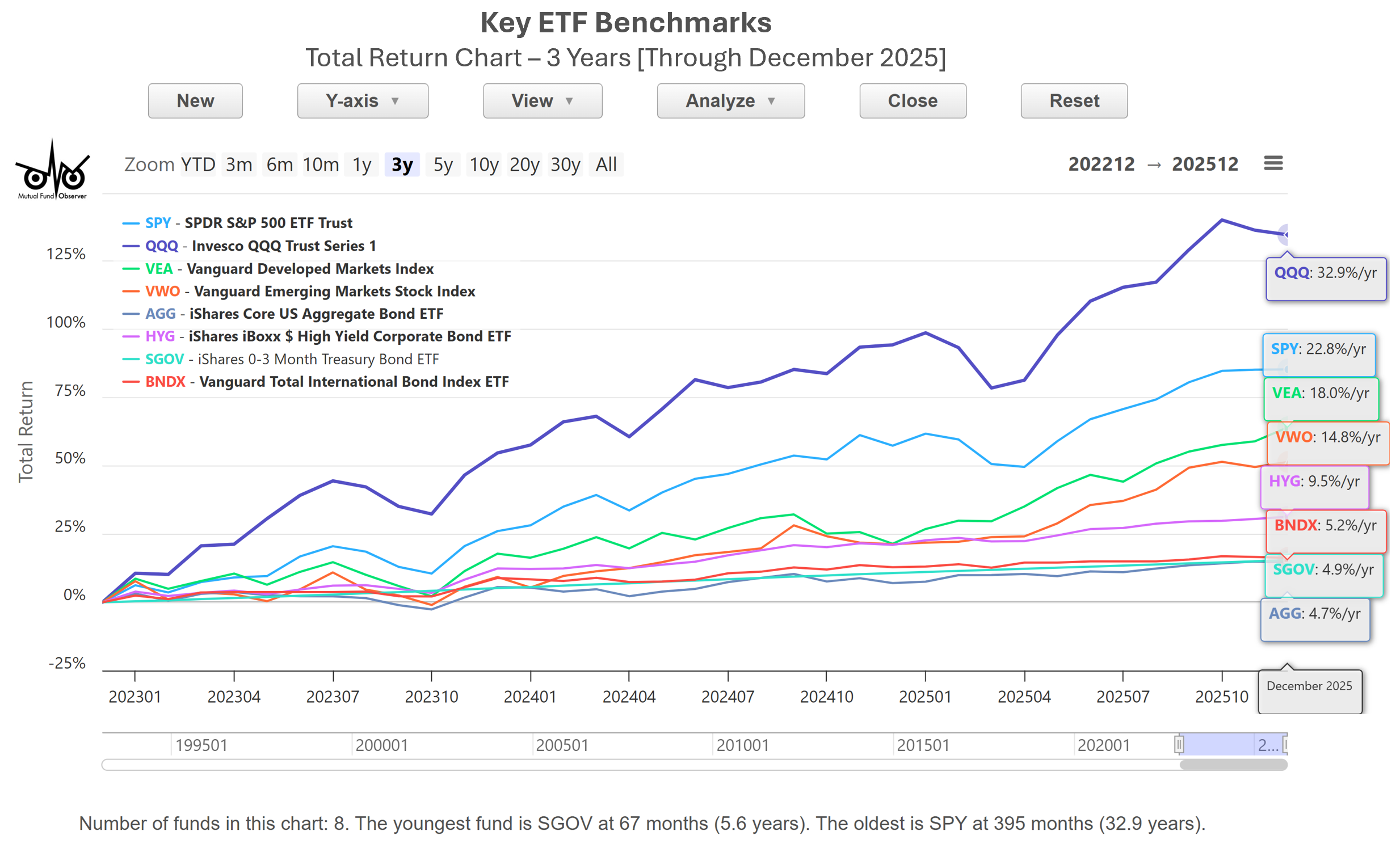

Other tools include Flows, Family Scorecard, Dashboard of Launch Alerts, Portfolios, Category Averages, MFO Charts, and Quick Access Analytics, plus our legacy QuickSearch, Risk Profile, Dashboard of Profiled Funds, Great Owls and Three Alarm Funds. Visit Screenshots page to preview all.

Performance updates are posted monthly, typically on first Saturday of the month. Month-to-date performance and other ancillary info, like holdings, are updated weekly. Flows are updated 1st and 3rd Saturday of the month, but our comprehensive FLOW tool updates daily.

MultiSearch, our main search tool, will sort through thousands of funds based on up to 300 screening criteria. Its Pre-Set Screens provide an easy way to get a quick overview on markets and notable funds. The example below depicts risk and return metrics for the Dodge & Cox fund family during the current market cycle, coined "The Great Normalization." Only a few of the more than 1000 metrics available in the table are illustrated.

Other tools include Flows, Family Scorecard, Dashboard of Launch Alerts, Portfolios, Category Averages, MFO Charts, and Quick Access Analytics, plus our legacy QuickSearch, Risk Profile, Dashboard of Profiled Funds, Great Owls and Three Alarm Funds. Visit Screenshots page to preview all.

Performance updates are posted monthly, typically on first Saturday of the month. Month-to-date performance and other ancillary info, like holdings, are updated weekly. Flows are updated 1st and 3rd Saturday of the month, but our comprehensive FLOW tool updates daily.

Features

- Lipper Global Data Feed and Lipper Global Flow Feed.

- U.S. Mutual Funds, ETFs, ETNs, CEFs, Interval and Insurance Funds.

- All share classes, survivors only.

- Extensive risk and return metrics back to 1960.

- Key US index and allocation performance back to 1926.

- Tailorable, sortable, and exportable result tables.

- Storable Watchlists, Searches, and Preferences.

- Some 145 evaluation periods, including lifetime, YTD, multi-year, multi-month, decadal, calendar decade, plus full, bear, bull and other unique market cycles.

- A suite of analytics: Flows, Correlation, Rolling Averages, Up/Downside Capture, Calendar Year and Fixed Period Metrics, Batting Averages, Benchmark Comparisons, Trend and Momentum, Lipper Leaders, Category Averages and Ferguson Metrics.

How to subscribe?

Premium MFO membership is $120 per year ($85 is tax-deductible to the extent allowable under law).

Create an account by clicking on LOGIN tab above. Access is granted automatically after email verification and PayPal portal payment. (You do not need a PayPal account to use the portal.) Writing a check also works. Drop us an email (david@mutualfundobserver.com) when the check is in the mail and we will access you pronto.

Current subscribers can extend or renew subscriptions any time via ACCOUNT tab. All subscriptions are non-recurring (we don't believe in auto-renewal).

User feedback drives near continuous site upgrades, so if you have any issues, see something amiss, or have suggestions for improvement, please email (admin@mfopremium.com). We will address soonest.

Premium MFO membership is $120 per year ($85 is tax-deductible to the extent allowable under law).

Create an account by clicking on LOGIN tab above. Access is granted automatically after email verification and PayPal portal payment. (You do not need a PayPal account to use the portal.) Writing a check also works. Drop us an email (david@mutualfundobserver.com) when the check is in the mail and we will access you pronto.

Current subscribers can extend or renew subscriptions any time via ACCOUNT tab. All subscriptions are non-recurring (we don't believe in auto-renewal).

User feedback drives near continuous site upgrades, so if you have any issues, see something amiss, or have suggestions for improvement, please email (admin@mfopremium.com). We will address soonest.

Mutual Fund Observer, Inc.

5456 Marquette Street

Davenport, IA 52806

5456 Marquette Street

Davenport, IA 52806

MultiSearch found funds meeting your criteria, exceeding fund display limit. Only first funds with highest APR will be displayed. Or, you can narrow search with additional criteria.

Compare can be performed on 1 fund minimum and 12 funds maximum. Either refine search or select rows accordingly.

Correlations can be performed on 2 funds minimum and 12 funds maximum. Either refine search or select rows accordingly.

Fund limit for this analytics tool is . Either refine search or select rows accordingly.

Fund limit for this analytics tool is . If search is completed, select rows from results table below; otherwise, complete the search.

Please select rows you wish to delete (by clicking on them) before hitting Delete button.

Please select up to 100 rows (funds) to save to Watchlist. Either refine search or select rows accordingly.

Please select evaluation (Display) period.

Your allocation must be from 0% to 100%. Allocation will be divided evenly for any unallocated funds in the portfolio, as applicable.

To save current Symbol selection, please choose a Watchlist to overwrite:

You are about to overwrite the Watchlist(s) below in your profile. To confirm overwrite or to cancel, please select button accordingly:

Your saved Watchlists are different from the ones you are running. To confirm overwrite or run without saving, select from buttons below:

Note: Watchlists can be saved to your profile from the MultiSearch Results page via the Export button. So, a good way to test for candidate Watchlists is to run Search using the normal Symbol input entry or other criteria.

Create a new watchlist or overwrite an existing watchlist with Symbols from current results?

Would you like to nickname the new watchlist now?

Error deleting Watchlists.

Watchlists saved successfully.

Watchlist was saved successfully.

Error saving Watchlists ... sorry. You might try editing the Watchlists. If the error persists, please contact admin@mfopremium.com.

To save current screening criteria, please choose a Search to overwrite:

You are about to overwrite the Search(s) below in your profile. To confirm overwrite or to cancel, please select button accordingly:

Your saved Searches are different from the ones you are running. To confirm overwrite or run without saving, select from buttons below:

Use selected crieria above to create new search? Or, just save existing searches as defined below?

Would you like to nickname the new search now?

Error deleting Searches.

Search was saved successfully.

Searches saved successfully.

Error saving Searches ... sorry. You might try editing the Searches. If the error persists, please contact admin@mfopremium.com.

To save current preferences, please choose a Preference to overwrite:

You are about to overwrite the Preference(s) below in your profile. To confirm overwrite or to cancel, please select button accordingly:

Your saved Preferences are different from the ones you are setting. You can cancel or confirm overwrite with buttons below:

Create a new preference or overwrite existing preference based on current settings?

Would you like to nickname the new preference now?

Error deleting Preferences.

Preference was saved successfully.

Preferences saved successfully.

Error saving Preferences ... sorry. You might try editing the Preferences. If the error persists, please contact admin@mfopremium.com.

You are about to overwrite the Portfolio(s) below in your profile. To confirm overwrite or to cancel, please select button accordingly:

Your saved Portfolios are different from the ones you are running. To confirm overwrite or run without saving, select from buttons below:

Error deleting Portfolios.

Portfolios saved successfully.

Error saving Portfolios ... sorry. You might try editing the Portfolios. If the error persists, please contact admin@mfopremium.com.

Sorry, something is wrong ... two failed attempts to read a required datafile. The search tool will keep trying or you can cancel and try again.

If the problem persists, please try reloading or exiting the browser page and then returning to MFO Premium.

If the problem still persists, please contact admin@mfopremium.com to get the issue resolved soonest.

If the problem persists, please try reloading or exiting the browser page and then returning to MFO Premium.

If the problem still persists, please contact admin@mfopremium.com to get the issue resolved soonest.

Funds not found.

Please specify additional criteria.

Please correct entry:

Please correct entry:

Note: QuickSearch covers only Mutual Funds and ETFs, oldest share class.

Note: QuickSearch covers only Mutual Funds and ETFs, oldest share class.

Please correct entry: in

Please correct entry: in

Please limit search to . Eliminate .

names must have a minimum of two letters to search.

Please wait momentarily for MultiSearch to finish pre-loading. Search will then launch automatically.

This nickname already exists. Please choose another nickname.

// new approach to column selection ... 12jun21

Please select at least one column group.

Update saved Preference before conducting new search?